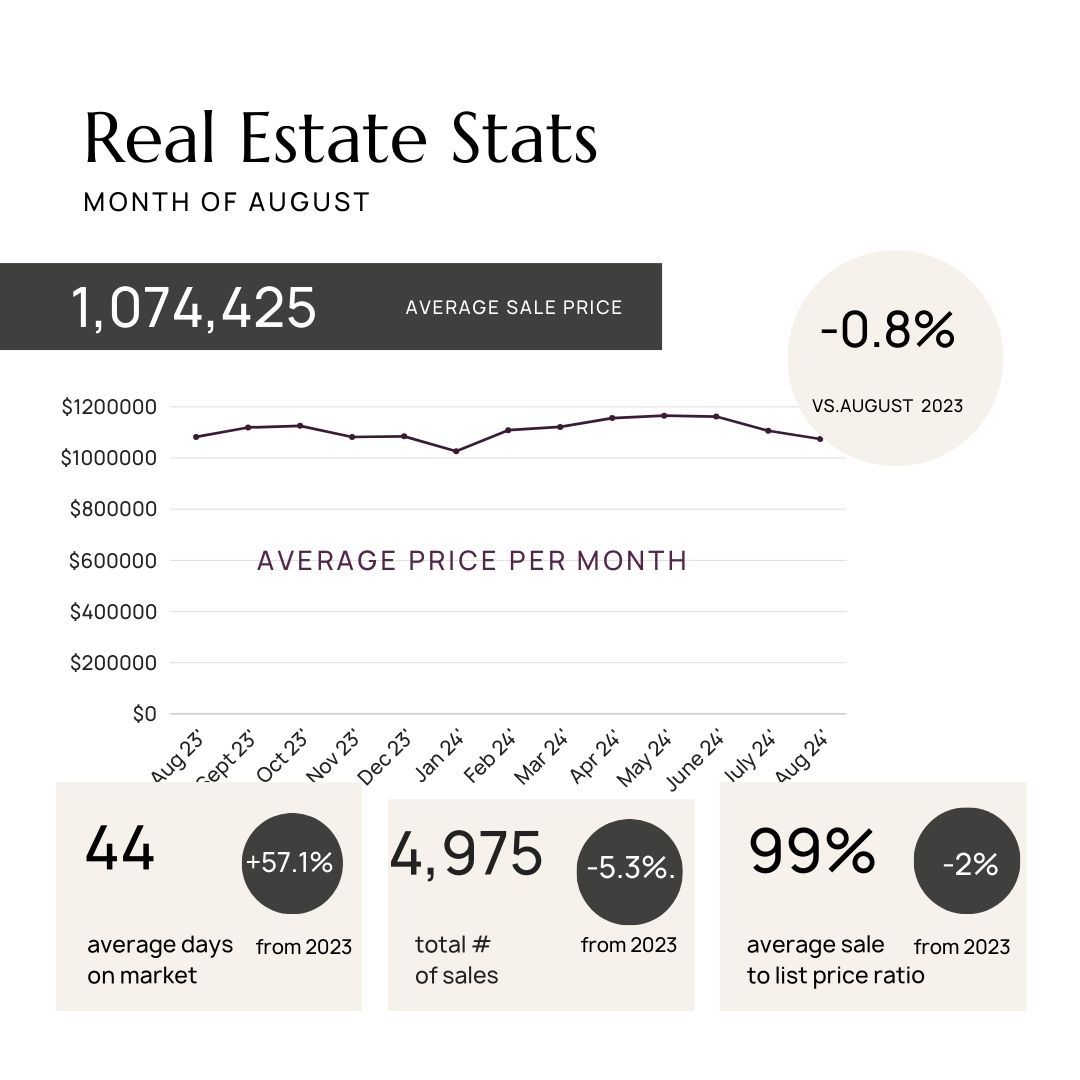

The Greater Toronto Area (GTA) real estate market experienced a modest downturn in home sales during August 2024, with year-over-year numbers showing a 5.3% drop compared to August 2023. However, despite the decline in sales, new listings increased slightly by 1.5% during the same period, signaling a well-supplied market heading into the latter part of the year.

While the real estate market has remained stable, there has been a slight dip in home prices. Average home prices in the region edged lower compared to last year, though the decline was minimal at 0.8%, bringing the average price to $1,074,425. Similarly, the MLS® Home Price Index Composite benchmark was down 4.6% year-over-year.

On a seasonally adjusted basis, home sales saw a slight increase compared to July, while new listings edged down slightly month-over-month.

Impact of Bank of Canada’s Rate Cut on Affordability

A notable development in the real estate landscape was the Bank of Canada’s recent rate cut, announced on September 4, which is expected to significantly impact affordability in the months ahead. This decision is particularly beneficial for first-time buyers, especially those using variable-rate mortgages. Lower borrowing costs tend to be a key driver for first-time buyers who are especially sensitive to mortgage rate changes.

TRREB President Jennifer Pearce emphasized the potential for increased first-time buyer activity:

“The Bank of Canada’s rate cut will lead to a further improvement in affordability, especially for those using variable-rate mortgages. As mortgage rates continue to trend lower this year and next, we should experience an uptick in first-time buying activity, including in the condo market.”

This trend, combined with a steady supply of housing, could create favorable conditions for buyers looking to enter the market.

Market Overview: Sales and Price Trends

In August 2024, GTA REALTORS® reported a total of 4,975 home sales through the TRREB MLS® System, down from 5,251 in August 2023. However, new listings rose to 12,547, reflecting a 1.5% year-over-year increase. The slight imbalance between sales and listings has helped maintain a well-supplied market.

The difference in the annual rates of change between the MLS® HPI Composite and the average selling price is largely due to an increase in the share of detached home sales compared to last year, which skewed the average price. On a seasonally adjusted basis, the average selling price dipped compared to July, continuing a trend of moderate price adjustments throughout the year.

What Lies Ahead: Lower Borrowing Costs and Future Market Trends

TRREB Chief Market Analyst Jason Mercer shared insights into what the future holds for buyers and sellers in the GTA:

“As borrowing costs trend lower over the next year-and-a-half, home buyers will initially benefit from both lower monthly mortgage payments and lower home prices. Even as demand picks up, especially in 2025, it will take time for the inventory of listings to be absorbed.”

Mercer noted that while demand will rise as interest rates continue to drop, there will be ample inventory in the market, which will help moderate price growth at least during the initial stages of recovery.

Housing Affordability and Supply Challenges

While the rate cut and increased affordability are positive developments, there are still challenges ahead for the GTA housing market. TRREB CEO John DiMichele highlighted the need for continued focus on increasing housing supply, particularly for creating homes that meet consumers’ needs at more affordable price points.

DiMichele stressed that municipalities need to play a role in addressing affordability by reducing development charges, which are often passed on to home buyers. He warned that without affordable housing options, people will move away from the GTA, and not necessarily to other parts of Ontario or even Canada.

“Today’s elevated listing inventory will ultimately recede. We need to maintain a sustained focus on boosting home construction, especially as it relates to producing the right mix of home types to meet consumers’ needs,” DiMichele said.

“If people can’t find affordable housing in the GTA or surrounding Greater Golden Horseshoe, they will move elsewhere, and not necessarily to other parts of Ontario or Canada. Housing is a key driver of our region’s economic development.”

Conclusion

The GTA housing market is in a period of adjustment, with a balanced supply of listings and a slight decline in sales and prices. However, the recent rate cut by the Bank of Canada offers a brighter outlook for buyers, especially first-time homebuyers. As borrowing costs decrease, the market is likely to see a gradual uptick in activity. However, affordability remains a challenge that requires ongoing efforts to increase housing supply and reduce costs for home buyers.

For those looking to enter the market, especially first-time buyers, this could be the right moment to explore options as favourable conditions emerge over the next year.

Until next time, don’t forget I am always here to help!