In February 2024, the Greater Toronto Area (GTA) witnessed a notable surge in both home sales and new listings, demonstrating an upward trend on an annual and monthly basis. Concurrently, selling prices experienced a marginal increase compared to the corresponding period in the previous year. The prevailing factors contributing to this growth include sustained population expansion and the resilience of the regional economy, collectively underpinning the enduring demand for housing. However, it is very important to note that the escalation in borrowing costs has tempered home sales, and it has prevented them from reaching the peak levels observed in February 2021.

According to Jennifer Pearce, President of the Toronto Regional Real Estate Board (TRREB), recent market dynamics indicate a resurgence in sales activity compared to the previous year. This resurgence is attributed mainly to the prevailing sentiment that the Bank of Canada has concluded its cycle of interest rate hikes. Consequently, prospective buyers are anticipating forthcoming rate reductions. Furthermore, many homebuyers have acclimated to elevated mortgage rates over the preceding two years, thereby adopting prudent measures such as augmenting down payment reserves, seeking more economical housing options, or exploring alternative locales within the GTA.

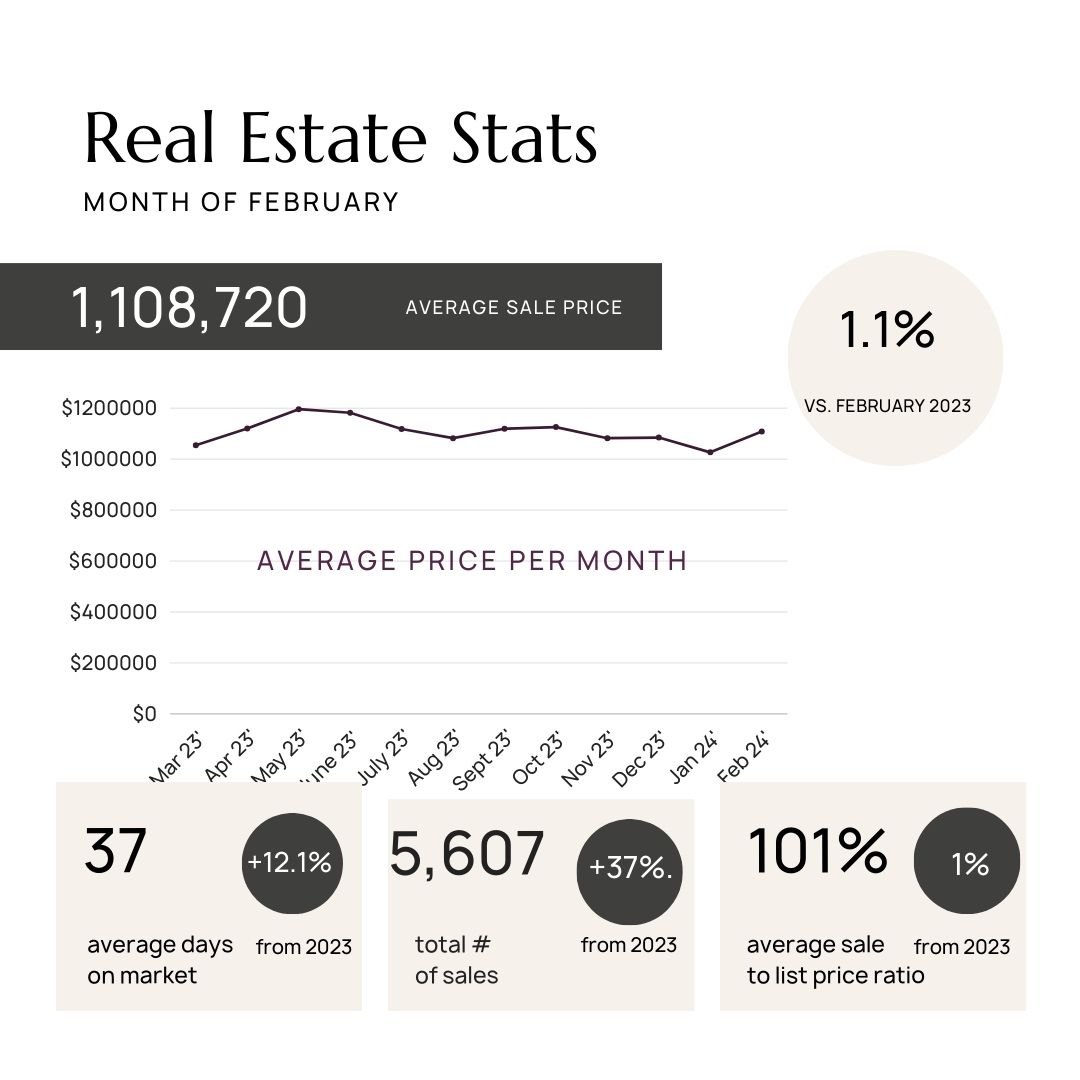

TRREB reported 5,607 home sales through its MLS® System in February 2024, reflecting a substantial year-over-year increase of 17.9%. Even after adjusting for the leap year effect, sales exhibited a notable upsurge of 12.3% compared to the corresponding period last year. Moreover, the surge in new listings outpaced the sales growth rate, indicating an expanding array of choices for prospective buyers. On a seasonally adjusted month-over-month basis, February sales moderated marginally following two consecutive months of growth, while new listings remained relatively stable. It is acknowledged that monthly metrics can exhibit volatility, particularly during transitional phases within the market cycle.

Despite the buoyancy in sales, home selling prices in February 2024 remained relatively consistent with those of February 2023. The MLS® Home Price Index Composite benchmark registered a marginal increase of 0.4%, while the average selling price of $1,108,720 demonstrated a modest uptick of 1.1%. Notably, the MLS® HPI Composite and the average selling price experienced marginal increases on a seasonally adjusted monthly basis.

Looking ahead to the remainder of 2024, Jason Mercer, TRREB’s Chief Market Analyst, anticipates a resurgence in buyer activity characterized by adjusted housing preferences to accommodate heightened borrowing costs. Furthermore, the anticipated reduction in interest rates in the latter half of the year is expected to stimulate demand for homeownership. Mercer underscores the significance of first-time homebuyers entering the market, driven by a desire to transition from renting to long-term property ownership to accrued equity.

Moreover, Mercer emphasizes the pivotal role of population growth in driving demand for housing, both in terms of ownership and rental properties, over the ensuing two years. Acknowledging the profound societal and economic implications of housing affordability, recent research conducted by TRREB underscores the adverse effects on mental well-being and life satisfaction.

In conclusion, while acknowledging the challenges posed by escalating housing costs, there is optimism surrounding ongoing efforts to address housing needs within the GTA. Notably, initiatives aimed at streamlining regulatory processes to facilitate increased housing supply are commendable and augur well for the region’s housing market dynamics. So, stakeholders are advised to look over developments closely, knowing the potential opportunities and challenges in this evolving landscape.