Home sales were up in January 2024 in comparison to January 2023. This annual increase came as some homebuyers benefited from lower borrowing costs associated with fixed-rate mortgage products. New listings were also up year-over-year but at a lesser annual rate than sales.

Compared to the same period a year earlier, tighter market conditions indicate renewed price growth as we move into the spring market. “We had a positive start to 2024. The Bank of Canada expects the inflation rate to recede as we move through the year.

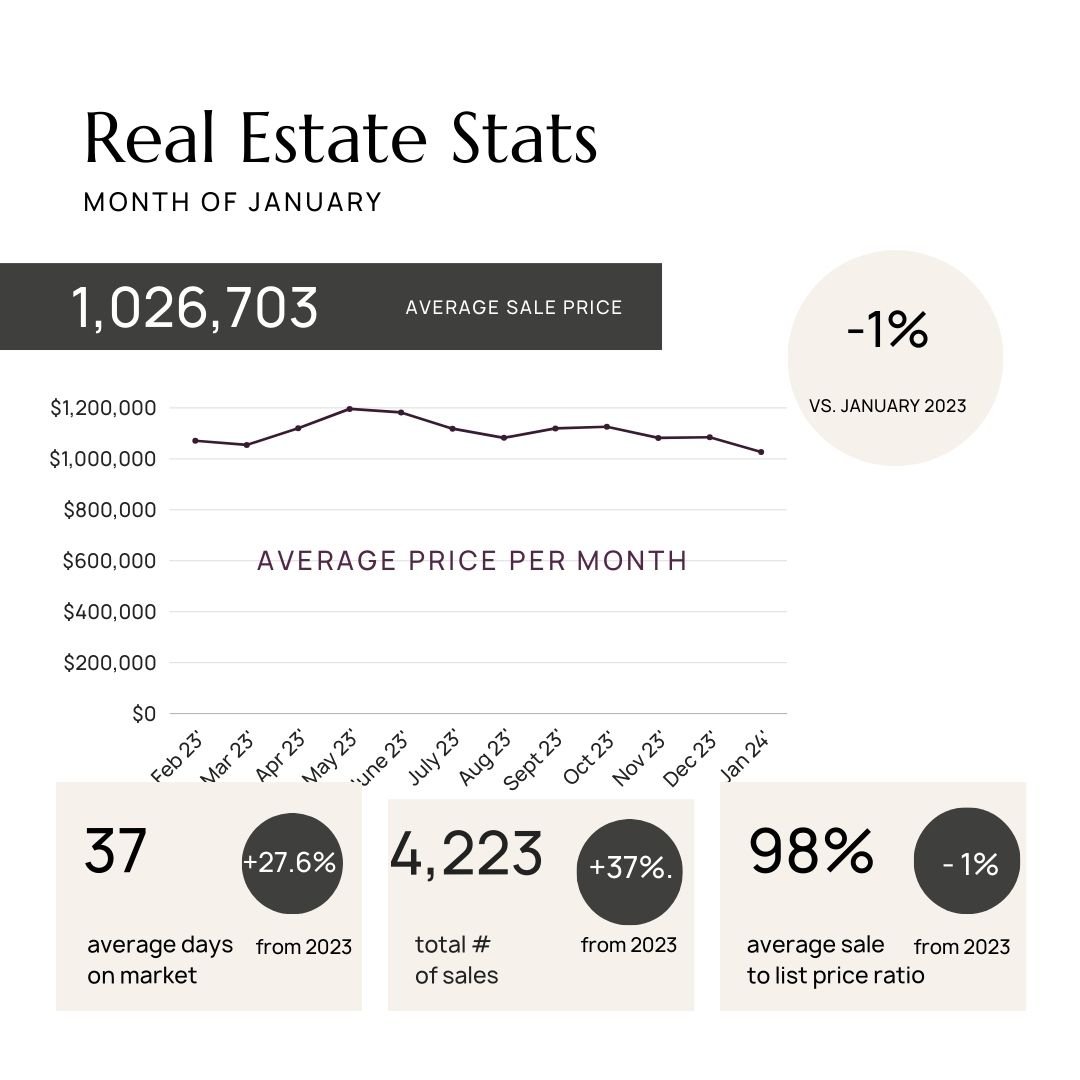

This would support lower interest rates, which would bolster home buyers’ confidence in moving back into the market. First-time buyers currently facing high average rents would benefit from lower mortgage rates, making the move to homeownership more affordable,” said TRREB President Jennifer Pearce. There were 4,223 sales reported through TRREB’s MLS® System in January 2024 – an increase of more than one-third compared to January 2023.

The number of new listings was up year-over-year but by a lesser annual rate of approximately six percent. Stronger sales growth relative to listings suggests buyers experienced tighter market conditions than a year ago. On a month-over-month seasonally adjusted basis, sales and new listings were up. Sales increased more than listings, so market conditions tightened relative to December 2023. “Once the Bank of Canada starts cutting its policy rate, likely in the second half of 2024, expect home sales to increase even further.

There will be more competition between buyers in 2024 as demand picks up and the supply of listings remains constrained. The end result will be upward pressure on selling prices over the next two years,” said TRREB Chief Market Analyst Jason Mercer. The MLS® Home Price Index Composite in January 2024 was down by less than one percent year-over-year. The average selling price was down by one percent year-over-year to $1,026,703. On a month-over-month seasonally adjusted basis, the MLS® HPI Composite and the average selling price also trended lower.

“While housing market conditions are expected to improve with lower borrowing costs, some policy issues still need to be addressed. More reflection on the Office of the Superintendent of Financial Institutions (OSFI) mortgage stress test is required at the federal level, especially in its application at different points in the interest rate cycle. The province needs to focus on building 1.5 million new homes. At the municipal level, raising property taxes without consistent support from the federal and provincial governments won’t eliminate Toronto’s structural deficit. Helping first-time homebuyers get into the ownership.