High borrowing costs and uncertain economic conditions weighed on Greater Toronto Area (GTA) home sales in November 2023. Sales were down on a year-over-year basis, while listings were up from last year’s trough in supply. With more choice in the market, selling prices remained flat year-over-year. “Inflation and elevated borrowing costs have taken their toll on affordability. This has been no more apparent than in the interest-rate-sensitive housing market.

However, it does appear relief is on the horizon. Bond yields, which underpin fixed-rate mortgages, have been trending lower, and an increasing number of forecasters are anticipating Bank of Canada rate cuts in the first half of 2024.

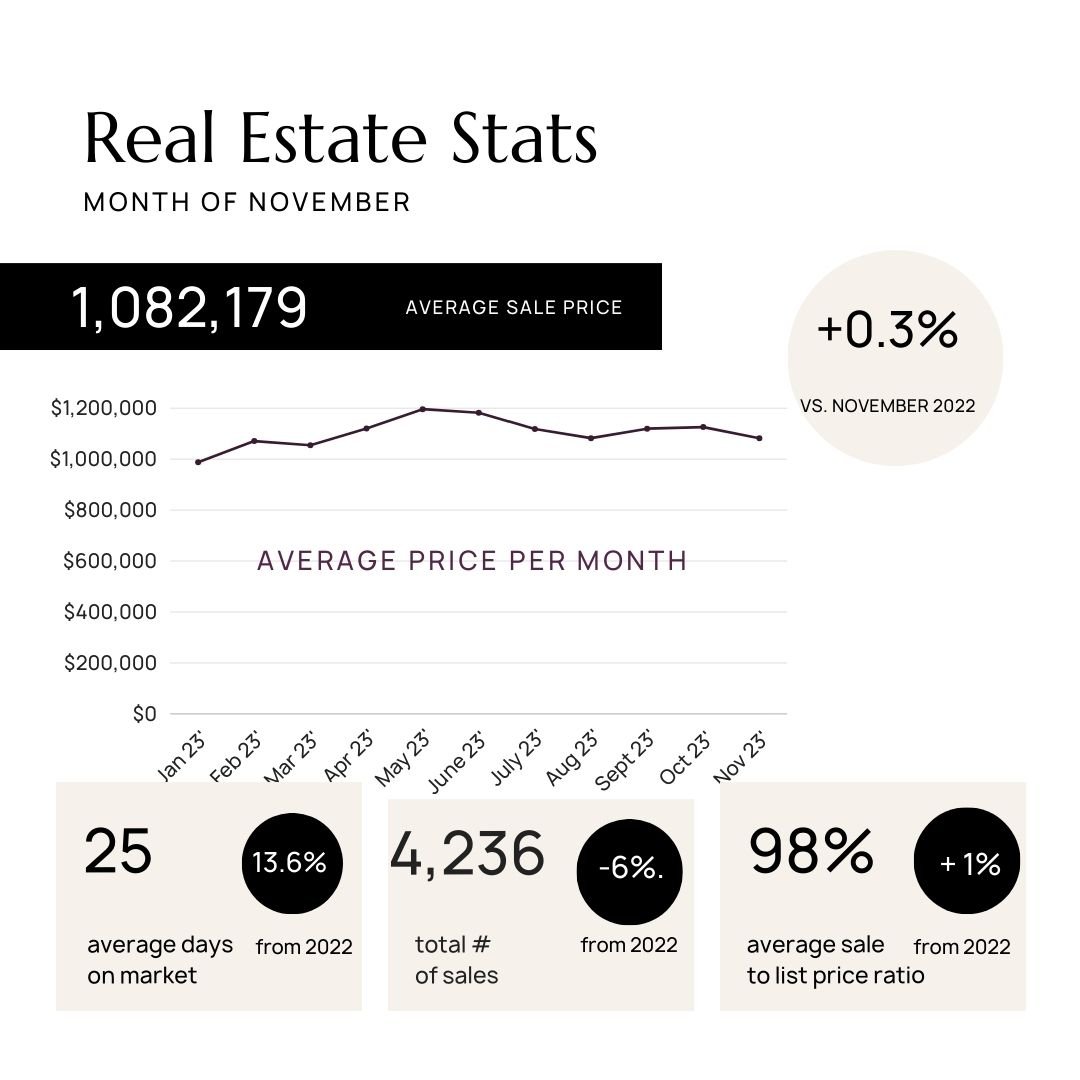

Lower rates will help alleviate affordability issues for existing homeowners and those looking to enter the market,” said Toronto Regional Real Estate Board (TRREB) President Paul Baron. GTA REALTORS® reported 4,236 sales through TRREB’s MLS® System in November 2023 – a six percent decline compared to November 2022. Over the same period, new listings increased by 16.5 percent. On a seasonally adjusted monthly basis, sales increased compared to October 2023, while new listings were down by 5.5 percent.

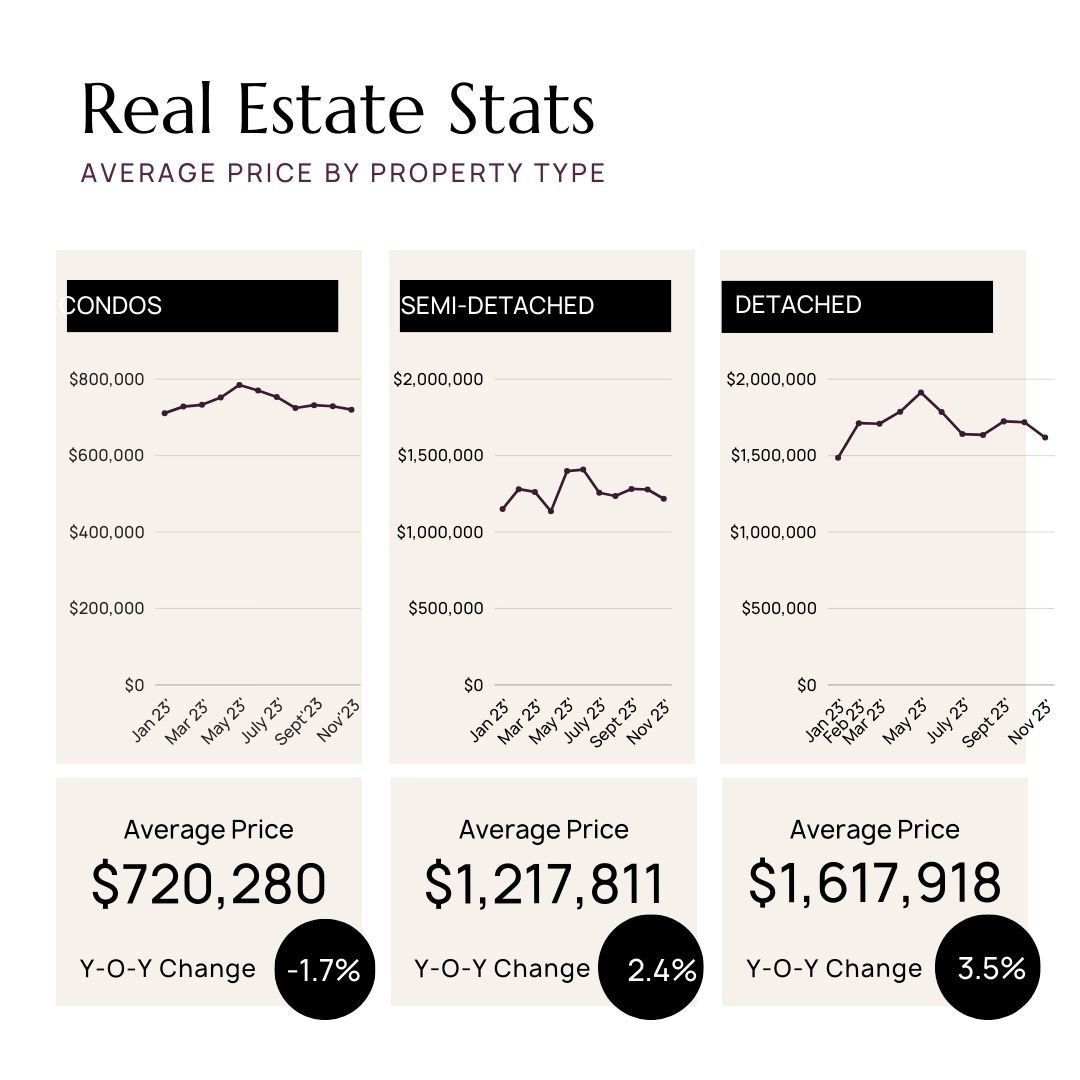

The MLS® Home Price Index Composite benchmark and the average selling price, at $1,082,179, in November 2023 were flat compared to November 2022. The MLS® HPI Composite benchmark was down by 1.7 percent on a seasonally adjusted monthly basis.

The average selling price was down 2.2 percent month-over-month. “Home prices have adjusted from their peak in response to higher borrowing costs. This has provided some relief for buyers from an affordability perspective. As mortgage rates trend lower next year and the population grows rapidly, expect demand to increase relative to supply. This will eventually lead to renewed growth in home prices,” said TRREB Chief Market Analyst Jason Mercer.

“Houses and condos are meant to be homes, first and foremost. We know the demand for homes, both rental and ownership, will grow for years. We have seen some productive policy decisions recently that should help with housing affordability, including allowing existing insured mortgage holders to switch lenders without the stress test. Additionally, in the interest of household and economic stability, we continue to call on the Office of the Superintendent of Financial Institutions (OSFI) to apply the same approach to uninsured mortgages. Further policy work is required to bring more supply online,” said TRREB CEO John DiMichele.